Article Directory

It’s a ghost in the machine. A phantom signal promising a lifeline that isn’t there. You’ve probably seen it. A text message buzzes on your nightstand, its screen glowing with a tantalizing subject line: “Your $1,702 IRS Stimulus is Pending.” For a split second, your heart leaps. A wave of relief, of possibility, washes over you. Maybe this will be the month you finally catch up. Maybe this is the break you’ve been waiting for.

And then, the cold wave of doubt hits. The oddly formatted link. The slightly-off grammar. You’re looking at a digital mirage, a carefully constructed illusion designed to prey on one of the most powerful forces in the human psyche: hope.

Let’s be crystal clear about the facts, so we can get to the far more interesting truth. There is no new federal stimulus payment planned for 2025. Not in October, not before the end of the year. The last of these federal programs, the Recovery Rebate Credit, was part of the 2021 American Rescue Plan, and the final deadline to claim that money passed on April 15, 2025. The viral rumors of a $1,702 payment? That was a wild misinterpretation of Alaska’s Permanent Fund Dividend, a state-specific payment funded by mineral revenues that has absolutely nothing to do with the federal government or the IRS.

When I first saw the data on how widespread these scams have become, I honestly just sat back in my chair, speechless. It’s not the technical aspect that’s so staggering, but the sheer, heartbreaking scale of the vulnerability it reveals. This is the kind of problem that reminds me why I got into this field in the first place—to understand how technology intersects with our deepest human needs.

The Anatomy of a Digital Mirage

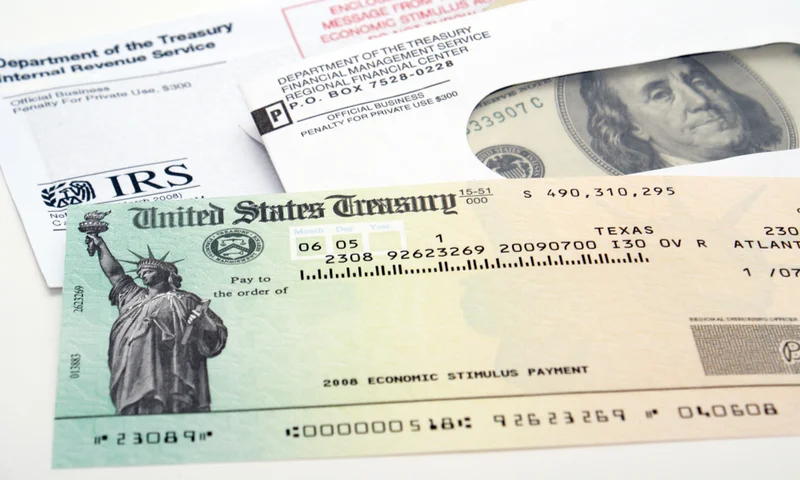

The mechanics of these scams are a masterclass in social engineering. They are designed to bypass our rational brains and hit us right in the gut. Scammers are using official-sounding language, mimicking government websites, and even mailing out incredibly convincing fake checks that require you to call a number and “verify” your banking information to cash them. They’re running a phishing operation—in simpler terms, they’re dangling a shiny lure in the water, waiting for you to bite so they can steal your identity or drain your bank account.

Law enforcement in places like Northern Virginia are already chasing down local fraud cases, but it’s like playing whack-a-mole in an infinite arcade. For every scam site they shut down, ten more pop up, fueled by the viral engine of social media.

But here’s the thing: focusing on the technical details of the scam is like analyzing the chemical composition of the ink on a counterfeiter’s dollar bill. It’s interesting, sure, but it completely misses the point. The real question isn’t how they’re faking the check. The real question is why, years after the last real stimulus, are millions of people so ready—so desperate—to believe the fake one is real? What does this ghost signal tell us about the state of our society?

The Engine of Desperation

This isn’t just a cybersecurity problem; it's a profound economic and psychological one. These scams are flourishing in the fertile soil of financial precarity. They are a direct symptom of a reality where a single unexpected expense can be catastrophic for millions of families. The hope for a stimulus check has become a kind of modern folklore, a story we tell ourselves because the alternative is too bleak.

And the speed at which this folklore spreads is just staggering—a rumor starts on a fringe social media group and within hours it’s a viral tidal wave, amplified by algorithms that are designed to promote engagement, not truth, creating a massive, echoing feedback loop of false hope that official warnings from the IRS can barely penetrate. It’s the 21st-century version of the snake oil salesman, except this time the wagon is a global network that can reach into every pocket and whisper a personalized lie.

We’re witnessing a systemic failure. A failure of our information ecosystem to protect the vulnerable and a failure of our economic system to provide genuine stability. When people are clinging to the hope of a phantom direct deposit, it’s a sign that the official systems have left them behind. So, what’s the answer? Do we just keep telling people to “be more careful online”? Or do we ask a bigger, more important question: How do we build a society where people are no longer vulnerable to these digital mirages in the first place? How do we build an economy so resilient and a safety net so strong that the promise of a scammer’s fake check loses its power?

We're Treating the Symptom, Not the Disease

Ultimately, this isn't a story about cybercriminals. It’s a story about us. Warning people about phishing scams is the equivalent of telling someone in a desert to be wary of mirages. It’s sound advice, but it doesn't solve the underlying problem: they’re still in a desert, and they’re still thirsty. The ultimate solution isn't just better digital literacy. It's building an economic and informational oasis—a system so transparent, equitable, and supportive that these predatory illusions simply fade away, unable to find a foothold in a world of genuine opportunity and security. That’s the paradigm shift we should be working toward.