Article Directory

SUI's Bold Claims vs. the Sobering Reality of Crypto Regulation in 2025

Sui bills itself as the blockchain that's going to change everything. Low latency, stable fees, parallel execution – the marketing materials are overflowing with promises. But let's pump the brakes for a second. Claims of revolutionary architecture are easy to make; backing them up with tangible results in the face of a rapidly evolving regulatory landscape is another story. I've seen too many "blockchain killers" flame out to take these pronouncements at face value.

The Object-Oriented Hype Machine

Sui's core selling point is its "object-oriented design." Everything is an object, supposedly allowing developers to build applications with "inherent network-wide compatibility." It sounds great on paper, but the devil's always in the implementation details. The claim is that explicitly defined transaction dependencies allow transactions to be executed in parallel. This parallel execution is supposed to dramatically improve network processes. Many transactions are finalized and settled in less than half a second while maintaining high throughput and stable transaction fees.

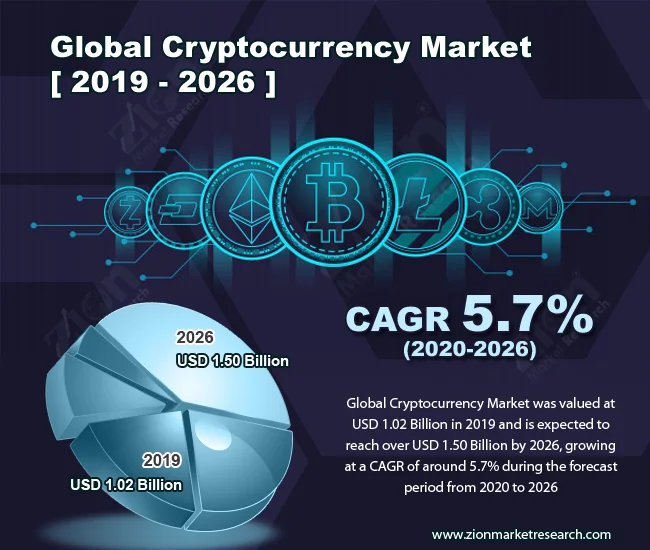

But, how does this object-oriented approach fare in the real world, where regulatory compliance is increasingly non-negotiable? The TRM Labs report points to stablecoins as a primary focus for regulators, with over 70% of jurisdictions progressing stablecoin regulation in 2025. Sui's object-oriented design, while technically interesting, doesn't magically make it compliant with regulations like the US's GENIUS Act or the EU's MiCA. These regulations focus on issuance, reserves, and redemption – aspects that are largely orthogonal to the underlying data model.

Is Sui's architecture actually helping developers build compliant Web3 applications? Or is it just creating a technically elegant system that still requires significant legal and regulatory overhead? This is the question I'm not seeing addressed.

Regulatory Reality Bites

Sui touts tools like zkLogin and sponsored transactions as solutions to "common barriers in Web3 adoption." zkLogin aims to simplify wallet onboarding, while sponsored transactions address transaction fees. These are nice-to-haves, not game-changers. The real barriers to Web3 adoption aren't technical; they're regulatory and psychological. People are scared of scams, rug pulls, and losing their money in unaudited smart contracts. Regulators are scared of money laundering, terrorist financing, and consumer protection violations.

The Global Crypto Policy Review Outlook 2025/26 Report paints a clear picture: "2025 was the year regulatory clarity met market momentum." Financial institutions are moving into the crypto space, but they're doing so in jurisdictions with clear, innovation-friendly regulation – the US, the EU, parts of Asia. Jurisdictions with "unclear rules or restrictions on bank participation in digital assets" are seeing financial institutions take a more cautious stance.

Sui's focus on Move, a programming language "tailored to Sui’s object-oriented data model," is another example of prioritizing technical features over regulatory realities. Move might help mitigate certain smart contract exploits, but it doesn't address the fundamental compliance challenges.

And this is the part of the analysis that I find genuinely puzzling. Sui seems to be operating under the assumption that technical innovation alone will drive adoption. But the data suggests otherwise. Regulatory clarity and institutional buy-in are the real drivers.

Sui's Missing Variable: Regulatory Acceptance

Sui's technology might be impressive, but it's operating in a world where regulatory acceptance is the primary bottleneck. The TRM Labs report emphasizes the importance of global consistency in crypto regulation to prevent regulatory arbitrage. North Korea's $1.5 billion hack on Bybit in early 2025, which was laundered through unlicensed OTC brokers and decentralized exchanges, underscores this point. The incident "illustrated how illicit actors exploit unregulated or lightly supervised technologies to obscure funds, reinforcing the need for better cross-jurisdictional coordination and real-time information sharing between compliant VASPs and law enforcement."

Sui's focus on technical solutions to adoption barriers is misguided. The real challenge is building a blockchain that can navigate the complex and rapidly evolving regulatory landscape. Until Sui can demonstrate a commitment to compliance and regulatory engagement, its bold claims of revolutionizing Web3 should be taken with a grain of salt – or, more precisely, a careful review of the latest regulatory filings.

The Reality Check

Sui needs to shift its focus from technical innovation to regulatory integration. The future of Web3 isn't about building the fastest, most scalable blockchain; it's about building a blockchain that can operate within the bounds of the law.